Last Updated on April 28, 2024 by Umer Malik

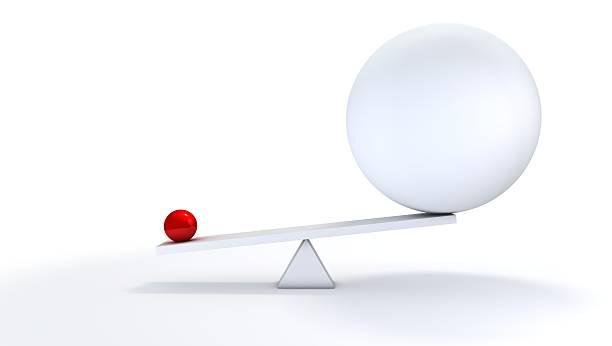

Trading in the financial markets requires a careful balancing act between reward and risk. Leverage and margin are two significant tools that traders can use to help them maximise their possible profits. Knowing how to use these tools effectively is essential for successful trading since they have the ability to magnify wins as well as losses. Let’s explore some core concepts in this subject matter.

Table of Contents

Leverage Explained:

Leverage stands as a financial instrument, empowering traders to command a more sizable market position using a fraction of their capital. Its main function is to increase the impact of price changes on a trader’s account.

For example, suppose a trader chooses a 10:1 leverage ratio. In this instance, they invest just $1,000 of their own money and take ownership of a $10,000 investment. This financial manoeuvring is particularly relevant for traders navigating the dynamic landscape of forex markets, including forex brokers in South Africa.

Advantages of Leverage:

1. Magnified Profits:

Leverage offers the opportunity for amplified profits as its main benefit. When leverage is used, a tiny change in market price might yield a significant percentage gain. This draws traders who want to increase their profits.

2. Diversification:

Leverage allows portfolio diversification by traders. Instead of investing substantial sums in a single asset, traders can use leverage to spread their investments across multiple positions.

Risks of Leverage:

1. Amplified losses:

While leverage can improve profits, it also significantly increases the risk of losses. These losses can mount up quickly if the market swings against the trader, and even a slight negative change in price can result in a significant loss of capital.

2. Margin calls:

Using leverage requires maintaining a minimum account balance, known as a margin. If losses erode the trader’s equity to a level close to the margin requirement, they might experience a margin call, which would mean they would need more money to cover any losses, or they might have to liquidate their investments.

Margin Explained:

Margin is the collateral that traders must maintain in their accounts to cover potential losses resulting from leveraged positions. It is given as a percentage of the entire size of the position. For instance, if a broker demands a 2% margin on a $10,000 position, the trader needs $200 in their account to initiate and keep the position open.

How to Use Leverage and Margin Wisely:

1. Risk management:

The key to using leverage and margin wisely is effective risk management. Traders should set clear stop-loss orders to limit potential losses and avoid overleveraging their positions.

2. Understand the market:

Before employing leverage, it is essential to have a thorough understanding of the market conditions and factors that can influence price movements. Informed decisions can help mitigate the risks associated with leverage.

3. Start small:

For new traders, it is important to start with smaller leverage ratios to gain experience and understand the impact of leverage on their trading account. As these traders gain experience, they can consider adjusting their leverage levels.

Conclusion:

Leverage and margin are powerful tools that can amplify both profits and losses in trading. They present chances for higher returns and portfolio diversity, but they also come with risks that need to be carefully considered and managed.

Traders should use prudence when dealing with leverage and margin, be aware of the possible dangers and benefits, and make decisions based on their risk tolerance and financial objectives.