Last Updated on February 24, 2023 by

An agent may also be liable to a third party if they lack the authority to contract for a principal. The agent may escape liability in this scenario if the third party knows the agent lacks authority, the principal ratifies/affirms the contract, or the agent notifies the third party of his lack of authority. However, the monthly principal and interest payments due are considered currently liabilities and are recorded as such on the balance sheet.

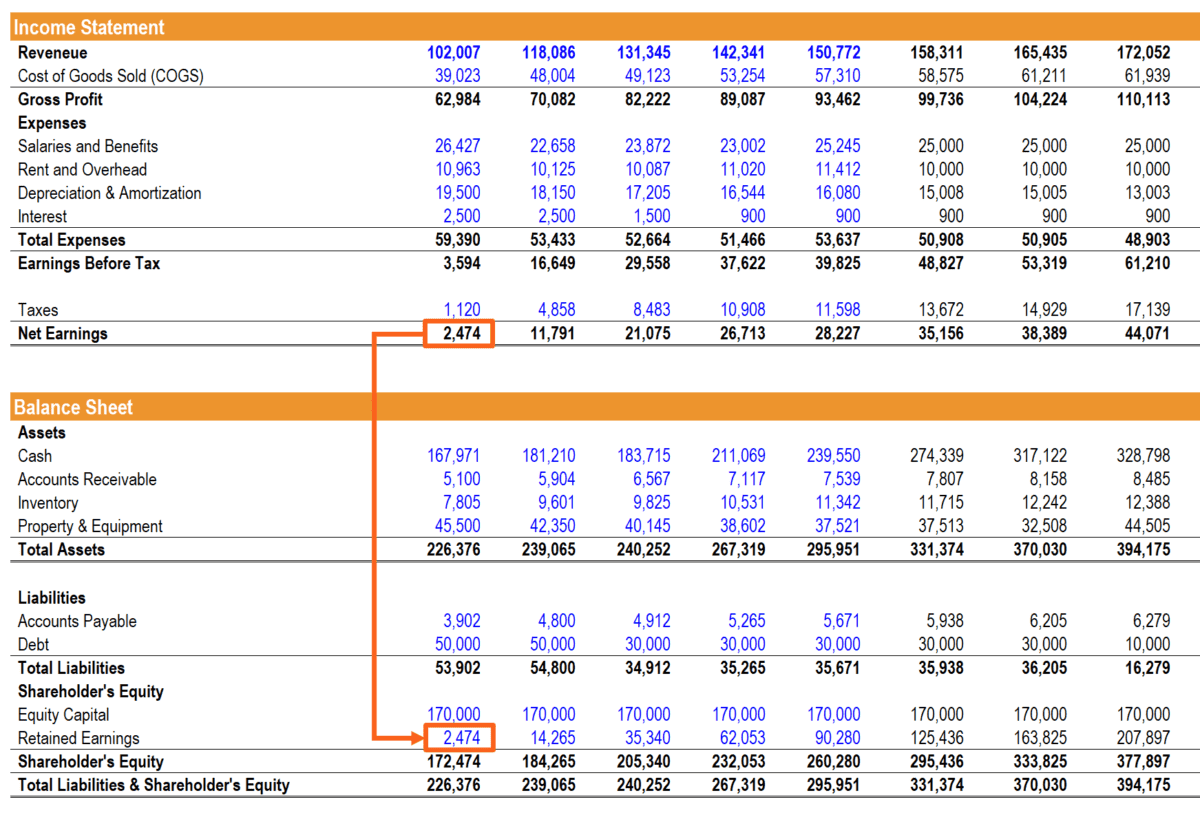

There is double taxation with a C corporation, first through taxes on profits and second on taxes on stockholder dividends . A year and 2016, Wallace Landscaping’s total assets were $2.17 million, and it accounts payable worth $560,000dollars.

Table of Contents

How To Analyze Business Liabilities

Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Your business balance sheet gives you a snapshot of your company’s finances and shows your assets, liabilities, and equity. Unlike most other liabilities, unearned revenue or deferred revenue doesn’t involve direct borrowing. Your business has unearned revenue when a customer pays for goods or services in advance. Then, the transaction is complete once you deliver the products or services to the customer.

Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Although average debt ratios vary widely by industry, if you have a debt ratio of 40% or lower, you’re probably in the clear. If you have a debt ratio of 60% or higher, investors and lenders might see that as a sign that your business has too much debt. Crime Insurance protects businesses from theft and malicious damage, such as employee embezzlement.

Common Liabilities In Small Business

This occurs when a principal’s actions lead a third party to reasonably assume that the agent can act in a certain way and create contracts with the third party on behalf of the principal. To determine if an agent is liable for a contract, one must look at the type of principal. A disclosed principal is known to the third party, and the third party knows that the agent is acting for this principal. types of liability The agent is not liable on authorized contracts made for a disclosed principal since all parties are aware of the contract and who is participating in the contract. An unidentified principal is seen when the third party knows the agent is acting for a principal but lacks knowledge on the principal’s identity. The agent is typically liable for contracts made for an unidentified principal.

- However, the monthly principal and interest payments due are considered currently liabilities and are recorded as such on the balance sheet.

- When such a sale occurs, the partner sustains a loss based on the argument that the basis of his or her partnership interest was not reduced by the transferred contingent liabilities.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- They are intrinsic to the most basic accounting needs as well as complicated review and compliance projects.

- John has gotten lazy about paying his electricity bill every month.

- While driving, you are responsible for an accident injuring six people in the other vehicle, with damages totaling $600,000.

Sales, which in 2016 worth $3.5 million, are expected to increase by 35% in 2017. Sam obtaining a loan from the bank is an example of a liability by contract, otherwise known as a notes payable.

Legal

A professional liability policy may also need to be purchased if the insured works in a profession that requires such coverage, such as doctors, attorneys, architects, and other professional occupations. Businesses purchase liability insurance to provide financial protection against lawsuits.

Unpaid bills, taxes, rent, or mortgage payments become liabilities for the payer. If someone is unable to satisfy a liability, a lien may be placed on the person’s property and his assets could be seized. His credit history may be negatively affected and he may be unable to take out a loan. It allows business stakeholders, from executives to investors, to track performance from a financial perspective, understand current assets and liabilities, make determinations about shareholder equity, and more. Assets are listed on the left side of balance sheets, representing holdings, money, and other resources a company owns.

Types Of Products Liability Claims

The more pressing need for the purchaser is to carefully assess the value of one’s possessions, the cost to replace it, and the likelihood of an incident that puts those possessions at risk. With that information in hand, you will be able to get an insurance policy that best suits your needs. Liability insurance covers accidents, damages, and harm on the job, on the road, and at home, with policies available for each category. You can also obtain coverage for claims against your company or professional role. Contingent liabilities – or potential risk – only affect the company depending on the outcome of a specific future event. For example, if a company is facing a lawsuit, they face a liability if the lawsuit is successful but not if the lawsuit fails. For accounting purposes, a contingent liability is only recorded if a liability is probable and if the amount can be reasonably estimated.

Good liability risk management is critical both to keeping premiums under control and avoiding losses. Umbrella Liability—also known as Excess Liability Insurance—provides extra protection for catastrophic events. The primary policies are called “underlying” policies and are specifically listed, along with their limits, on the umbrella policy. Typically, the underlying policies are your primary general liability, auto liability and the employer’s liability section of your workers comp policy.

Next Postusing A Twitter Presence To Grow Your Small Business

A ratio of 2 or more is considered ideal, whereas a ratio below that may signify lower liquidity and weaker short-term paying ability. Some businesses are legally or contractually required to purchase specialized forms of business liability coverage.

Employees are subjected to more control while nonemployee agents, like independent contractors, have more freedom in how they do their job. A principal is not ordinarily liable for torts committed by nonemployee agents since the principal does not fully control the method of work done.

Types Of Liabilities

As with other liability insurance policies, premiums for professional liability coverage depend on the type of professional service being provided and its level of risk. The debt-to-equity ratio is a solvency ratio calculated by dividing total liabilities (the sum of short-term and long-term liabilities) and dividing the result by the shareholders’ equity. It can help a business owner gauge whether shareholders’ equity is sufficient to cover all debt if business declines. This liquidity ratio helps a firm determine whether it can pay its short-term debt and meet its cash needs given its current assets and liabilities. To calculate it, divide the current assets by the current liabilities.

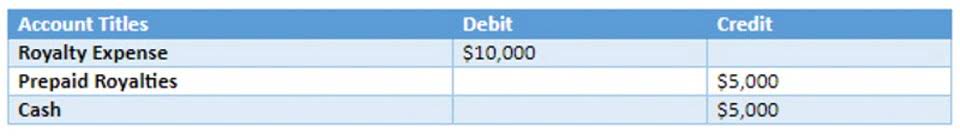

Liability by agreement is listed as accounts payable on the income statement. A products liability claim based on injuries caused by a defective consumer item can use a broad range of legal theories. Most often, these claims are brought under a theory of strict liability, but sometimes a theory of negligence may be more appropriate, depending on the state. The difference between strict liability and negligence is that strict liability does not require showing that the defendant acted carelessly, while negligence does require this element.

With SIR, the business pays out-of-pocket for smaller claims and retains the insurance company for larger claims. General business liability insurance does not cover property, workers’ compensation, or state disability, which are separate types of insurance coverage that may be required by state or federal law. In some industries, like construction, business contracts often require liability insurance coverage. Businesses in these higher-risk categories may choose to add vendors and subcontractors to their liability policy for the duration of a contract. Professional liability insurance typically covers claims of negligence; misrepresentation of goods or services; inaccurate or harm-causing counsel; and violation of the “good faith” terms of an agreement or contract.

The loan officer tells Sam he needs to provide a balance sheet of the known assets and liabilities. Sam tells the loan officer he’s familiar with known assets, which are owned items with a specific value, but he’s unclear about known liabilities. The loan officer starts by defining liabilities, which are obligations the business will owe.

Imputed negligence results in vicarious liability, where the principal is responsible for the acts of his agents. For example, employers have vicarious liability for the actions of their employees. If an employee injures someone in the course of employment, then it doesn’t matter whether the employer could have done anything to prevent it — the employer will be held liable regardless. If a patron drives after drinking at a tavern, and subsequently kills or injures someone with his vehicle, then the tavern owner can be held liable. Insurance is purchased to protect against losses, and a major source of loss, especially in this litigious society, is legal liability. Legal liability is the liability of a party imposed by a court for its actions or inactions, and for which the courts will award pecuniary damages to redress the injury. A legal wrong is either a violation of a person’s rights or the failure to perform a legal duty for a party.

If you manufacture, sell or distribute a product, there is the possibility that it could cause bodily injury or property damage for which you would be legally liable. Even if you only sell or distribute the product, you could still be liable depending on the circumstances. The limits of your coverage are set forth in your policy “Declarations.” The policy describes how the limits will be applied. The amounts are the most the insurer will pay, regardless of the number of persons or organizations making claims or bringing suits against you.

For example, under English law, with the passing of the Theft Act 1978, it is an offense to evade a liability dishonestly. In general, however, insurance providers only cover liabilities arising from negligent torts rather than intentional wrongs or breach of contract. Short term liabilities are obligations that need to be paid within a years time, which is why they are called short-term or current liabilities. AP typically carries the largest balances, as they encompass the day-to-day operations. AP can include services,raw materials, office supplies, or any other categories of products and services where no promissory note is issued.

- For an employer or parent to be held vicariously liable, the victim of the act must have suffered injury or property damage that would not have resulted without the action of the employee or child, regardless of intent.

- Trickle-Up Economics Describes the best tax policy for any country to maximize happiness and economic wealth, based on simple economic principles.

- If you’ve ever reviewed accounting documents for your business, chances are you’ve asked yourself “What is a liability?

- Calculation of such liabilities is on the basis of “what if the actual loss occurs” where ever possible and with an addition of a notional calculation of damage occurred to the person or entity.

- When a formal loan agreement has payment terms that go beyond one year , this is a notes payable.

- The partner argues that since these liabilities are contingent liabilities, their assumption by the partnership does not reduce the basis of the partner’s interest in the partnership.

- The company must recognize a liability because it owes the customer for the goods or services the customer paid for.

Serving alcohol to minors, for example, is a strict liability crime in many states. That means that a person who serves a minor is liable even if the minor lied about his age or presented a fake ID. For example, Sam would like to start selling new computers to customers whose computer cannot be fixed. The computer manufacturer gives Sam a contract to review their terms. Being able to sell new computers will definitely increase his sales. Bankrate.com is an independent, advertising-supported publisher and comparison service.

Author: Michael Cohn