Last Updated on July 22, 2024 by Ali Hamza

Do you think machine learning will eventually overtake bookkeepers and accountants? The accountants may find the convergence of numerous forms of technology, such as machine learning, cloud computing, and different sorts of automation, to be overwhelming. However, Artificial Intelligence and Machine Learning will not altogether remove the necessity for bookkeepers and accountants. Indeed, it will provide value to their operations by streamlining them and reducing human error by redistributing manual tasks.

Table of Contents

What is Machine Learning?

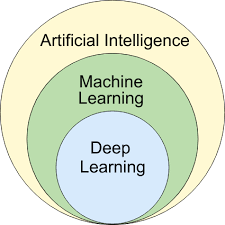

Machine learning is (AI)Artificial intelligence’s cutting-edge technology. It’s a branch of Artificial intelligence in which robots may learn by interpreting data from the outside world with algorithms to forecast events and learn from successes and mistakes. As machines enter accounting operations to take over other monotonous and repetitive jobs, accountants and bookkeepers will have more time to use their expert knowledge to interpret and evaluate data to make suggestions to their clients.

Artificial Intelligence in Auditing

AI has progressed beyond rote memory of tasks to the point where it can now learn by itself. Machine learning, or ML, employs artificial intelligence (AI) algorithms to find patterns in big datasets and predict outcomes or judgments with little or no human intervention. As it analyses more data, this sort of AI improves, and it may use speech recognition to translate spoken or written communication. Such type of AI is demonstrated by Amazon’s or Netflix’s suggestions. The datasets here could be structured, like a set of accounting operations, or unstructured, like satellite photos, email communications, or audio or video files — practically anything that can be digitized.

Accounting activities machines can learn

Instead of eliminating the human workforce in accounting companies, the accountants will be joined by new machines to serve clients with more effective and efficient accounting services. Presently, no computer can substitute the emotional intelligence required for accounting work, but robots can learn how to perform duplicate, repetitious, and frequently time-consuming operations. Here are a few examples:

web

Clear Invoicing

When clients group invoices into one expense, pay wrong amounts or don’t include the invoice numbers with the payment, accounts receivable or treasury clerks suffer from processing invoice payments. An accountant must either manually add up many invoices that correspond to the amount due or approach the client to verify some facts to clear the invoice. The work could be supported by an AI system that suggests bills that reflect the payment amount and, based on proven limits, immediately clear minor payments or issue a delta invoice.

Bank reconciliations

Machines can automate bank reconciliations. Accounting professionals can provide more value to their customers and manage more clients as accountants and agencies rely heavily on devices to do computation, reconciliations, and answering inquiries from other clients and colleagues about balance sheets and verifying information.

Determining bonus accruals

Firms might utilize AI solutions to delegate this calculation to a machine that analyses all present system data and predictive analytics capabilities to arrive at an unbiased total. Furthermore, accounting staff would have more time to work on projects requiring human interaction during the closing phase.

Risk assessment

Finance teams are entrusted with reviewing projects independently based on customer criteria when examining economic proposals for services such as maturation, sector, size, current network landscape, the intricacy of the goods to be implemented, and much more. The team often consults with finance department managers who have worked on similar projects before to make this judgment. This complete examination is not only impossible for any finance team to complete on such a vast scale and within such a tight schedule, but it also limits the conclusions due to these individuals’ viewpoints.

By gathering data from each project a company has ever completed and comparing it to a suggested project, machine learning could help simplify risk assessment mapping. The team could reach the proposed strategy to all previous initiatives and find a more accurate risk estimate using this information. As a result, finance managers may be able to give consumers a better deal with a minor risk uplift or guarantee that there is enough coverage in case the risk is severe. This skill has the potential to boost revenue and margins for the organization considerably.

Despite the fact that businesses hire large groups of accountants who work hours to meet deadlines and complete audits, the volume and quality of transactions that flow through firms restrict the number and quality of transactions that auditors can review manually. Currently, auditors only look at a small number of transactions. Machine learning patterns can process and analyze data, identify anomalies, and generate a list of aberrations for auditors to review. As a result, rather than spending most of their time verifying data, auditors can use their so rather than spend most of their time confirming details to examine and determine the cause of a trend or anomaly.

Transforming the role of finance

The primary goal of many chief financial officers (CFOs) is to utilize innovations that will positively influence their jobs and the financial market. The skills required of employees in the accounting and bookFkeeping functions will have to shift dramatically for this to occur. Transactional employment will become less critical, while commercial partnerships, cross-functional knowledge, and technological awareness will become increasingly important. These systems must also be developed, maintained, and incorporated into existing operational systems.

Even though the resources needed for these transactional processes will be reduced, the development and support of rapidly changing business patterns led by digitization will necessitate extra financial help. Many other operations, including HR, procurement, and legal, will be impacted similarly to finance. The most extraordinary thing executives can do to prepare for the effect of machine learning and artificial intelligence technology is to foster a learning culture among their staff to stay ahead of the curve. CFOs should educate themselves on this subject to guide their teams in changing when the time comes.

Read More: 5 Accounting Technology Trends Small Businesses Must Follow in 2022

Apart from that, if you are interested to know about Accounting For Ppp Loans then visit our Finance category.