Last Updated on July 13, 2024 by Asfa Rasheed

Interest receivable of $525 is credited for the interest recognized in the prior period. Also, interest revenue is credited $150 for the interest earned during the current period. Although it is possible to record the interest on a daily basis, this involves excess record keeping. For this reason, a single adjusting entry is made at the end of the accounting period.

We give an accrued revenue definition to explain the meaning and examples of accrued revenue. Accrued revenue is compared to unearned revenue and accounts receivable. The journal entry is made for accrued revenue as an asset and income statement revenue before billing and receiving cash from customers for proper revenue recognition in accounting. An adjusting entry to accrue revenues is necessary when revenues have been earned but not yet recorded. Examples of unrecorded revenues may involve interest revenue and completed services or delivered goods that, for any number of reasons, have not been billed to customers. Suppose a customer owes 6% interest on a three‐year, $10,000 note receivable but has not yet made any payments. At the end of each accounting period, the company recognizes the interest revenue that has accrued on this long‐term receivable.

Table of Contents

What Is Accrued Expense?

That’s why it is prudent to seek the advice of a professional with knowledge of different investment vehicles and various retirement planning strategies. To do this, we simply divide the coupon rate by 365, the number of days in a year, to arrive at the daily rate of interest. Our vision is to provide users with the highest quality information possible about their financial options and empower them to make informed decisions based on their unique needs. In Notes Receivable, we were the ones providing funds that we would receive at maturity. Now, we are going to borrow money that we must pay back later so we will have Notes Payable. Interest is still calculated as Principal x Interest x Frequency of the year. Barbara is currently a financial writer working with successful B2B businesses, including SaaS companies.

Net Present Value is the value of all future cash flows over the entire life of an investment discounted to the present. The flat price can be calculated by subtracting the accrued interest part from the full price, which gives a result of $1,028.08. Full BioMichael Boyle is an experienced financial professional with more than 10 years of working with financial planning, derivatives, equities, fixed income, project management, and analytics.

Suppose that interest for a business loan is payable on the 15th of each month, but your accounting period ends on the 30th of this calendar month. In this case, you will accrue 15 days of interest, from the 16th to the 30th.

Financial Accounting

The borrower must then remit any amount not forgiven by the SBA to the creditor in accordance with the terms of the PPP loan. If the SBA subsequently determines that the borrower was ineligible for the PPP loan, the borrower must immediately repay the loan to the creditor. Interest is calculated as the result of $40,000 x 9 percent x 1/12.

This figure would be added up and posted as part of your adjusting journal entries, and then reversed on the first day of the next month when the cash transaction is received. Accrual-based accounting requires revenues and expenses to be recorded in the accounting period when they are incurred, regardless of when the cash payments are made. The accrual-based accounting accrued interest journal entry method discloses a company’s financial health more accurately than the cash-based method. The accrued expenses journal entry is very important as part of the adjusting entries in the accounting cycle of the closing process. Such accrued expenses are considered as liabilities and shall be presented in the balance sheet as part of the liabilities section.

Calculating Accrued Interest During A Period

When a company incurs expenses, it creates an obligation in order to make the payment for such expenses. This obligation is the liability that the company possesses and shall be treated and recorded as accrued expenses regardless of whether payment has not been made. Sometimes, the account name for the accrued expenses can be varied in accordance with the nature of the expense. For example, the accrual of salary expense not yet paid is practically called salary payable, while the accrual for interest expense is called interest payable. School boards approve the note issuances, with repayments of principal and interest typically met within a few months. Debt sale to a third party is a possibility with any loan, which includes a short-term note payable. The terms of the agreement will state this resale possibility, and the new debt owner honors the agreement terms of the original parties.

- Interest income is the amount paid to an entity for lending its money or letting another entity use its funds.

- Accrued interest is usually counted as a current asset, for a lender, or a current liability, for a borrower, since it is expected to be received or paid within one year.

- The amount of accrued interest for the recipient of the payment is a debit to the interest receivable account and a credit to the interest revenue account.

- Cash increases as does Short-Term Notes Payable for the principal amount of the loan, which is $150,000.

- Bonds can be traded in the market every day, while their interests are usually paid annually or semi-annually.

When your small business has a note payable outstanding, you typically must make periodic interest payments. Accrued interest on a note payable is interest that has accumulated that you have yet to pay. A business typically records accrued interest at the end of an accounting period to update its accounts and financial statements.

Notes Payable:

Adjusting entries are made at the end of each month, quarter, and year, if the amounts involved are material to the business. To account for interest payable at the end of an accounting period, debit the amount due as an expense on the income statement. The balancing entry is made to the current liabilities account on the balance sheet. In the example, debit the interest payable account with $21.92 and the credit current liabilities account with the same amount.

The same is to be recognized by the company in its books of accounts, even if interest has not been received yet. Analyze the treatment of the interest received by the company and pass the necessary journal entries in the books of the bank. This value of $41.10 would be the amount of accrued interest covering the final ten days of the calendar month for this accounting period. Which represents the amount of interest expense that has accrued to date but has not been paid as of the date on the balance sheet. In short, it represents the amount of interest currently owed to lenders. Under accrual-based accounting, accrued interest is the amount of interest that has been incurred or earned in a reporting period, regardless of when it will be paid. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. The interest for 2016 has been accrued and added to the Note Payable balance. Free Financial Modeling Guide A Complete Guide to Financial Modeling This resource is designed to be the best free guide to financial modeling!

Accrued Interest

In each case, you are accounting for the transaction when it was earned. You have a choice of running your business under either cash accounting or accrual accounting. The difference is important because the accounting method you select affects the timing of revenue and expenses and can affect the amount of income tax your business pays in a year. A short-term note is classified as a current liability because it is wholly honored within a company’s operating period.

The last coupon payment was made on March 31, and the next payment will be on September 30, which gives a period of 183 days. If an organization decides to open a line of credit, it does not actually appear on the books of the organization until it is put into use. The line of credit is considered a liability because it is a loan. You will also need to record the amount of interest payable on the line of credit when there is a balance outstanding. The borrowing rate on the line of credit drives the interest payable amount. Short-term debt may be preferred over long-term debt when the entity does not want to devote resources to pay interest over an extended period of time. In many cases, the interest rate is lower than long-term debt because the loan is considered less risky with a shorter payback period.

However, at the end of the year, the principal and interest were not paid by the employee. On January 01, 2019 check was sent by the employee for the payment of the interest portion of the three months. At the maturity date, the cash account is debited for the entire value of the loan.

In the Transaction Date box, the next “calculated” date to create accrued interest transactions displays. The date is calculated by taking the last date accrued interest transactions were created and incrementing the date one month. It should be passed at the end of every period in order to prepare and present the correct monthly financial statement of the company to the stakeholders. Financial Statements Of The YearFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period.

Subsequently, the lessee calculates the amortization of the discount on the lease liability as interest expense. Unpaid interest is accrued in a separate liability account from the lease liability and any lease payments are allocated to accrued interest first. The entries listed above reflect the governmental fund and conversion entries for the first 13 months of the lease. This article focuses on cash versus the accrual basis for interest, which includes interest paid in cash, interest expense under US GAAP, and interest payable. The main reason that there is a difference between cash and accrual for interest is that interest expense is accrued based on the terms of the loan.

Accrued interest maintains an equitable balance between buyers and sellers. It’s paid to sellers because they earned it when they owned the bond. When the new owner receives the next full semiannual interest payment, it will include interest earned prior to the time the new owner actually owned the bond. Additionally, at the government-wide level, Bryant County calculates interest expense by multiplying the outstanding liability ($80,366) by the monthly discount rate (3% / 12 months). At the end of the first year, the county recognizes $2,411 to interest expense and the accrued interest liability. At the beginning of the second year, Bryant County makes its annual payment of $42,000.

On August 31st, a small business ships $25,500 in products to a customer. On September 1st, the business invoices the customer $25,500 for these products shipped on August 31st on account, extending credit with 2/10 net 30 credit terms. Accrued income is a kind of accrued revenue that applies to interest income and dividend income. Comprehensive income is all of the transactions that drive non-owner-related changes in the company’s equity. Discover the examples of non-owner-related changes and their definitions. One of the main categories of long-term assets is known as property, plant, and equipment, encompassing the location, buildings, and equipment needed in production. Learn how the acquisition of property, plant, and equipment is recorded and documented through an example of journaling.

These investors should know that there are many alternatives available to them. On the next payment date, the buyer, now the new owner, will receive the full interest payment of $2,000. This payment is 4 percent of $100,000 for 182.5 days — half a year — and includes the $690.41 accrued interest the buyer paid to the seller. The accrual period is simply the number of days since the bond last paid interest to the seller. To calculate an investor’s specific accrued interest, face value would be the total amount invested in the specific bond. Face value is multiplied by the bond’s stated, or coupon, rate of interest.

You need enough money to cover your expenses until you get your next paycheck. Once you receive that paycheck, you can repay the lender the amount you borrowed, plus a little extra for the lender’s assistance. Deferred annuities can be an effective option for investors seeking to build retirement savings using a taxable account. Using deferred annuities provides an additional benefit that zero-coupon bonds don’t have. And studies have shown that deferred annuities can improve retirement outcomes. We partner with Senior Market Sales, a market leader with over 30 years of experience in the insurance industry, to offer personalized retirement solutions for consumers across the country.

- Save money without sacrificing the features you need for your business.

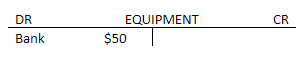

- To illustrate, let’s revisit Sierra Sports’ purchase of soccer equipment on August 1.

- A borrower applying IAS 20 by analogy should not present the income statement impact of any PPP loan forgiveness as revenue.

- The credit side of the adjusting journal entry is to record revenue.

- This figure would be added up and posted as part of your adjusting journal entries and then reversed on the first day of the next month when the cash transaction is received.

- It may also include a debit to the note payable account to account for any paid principal.

- The company assumed the risk until its issue, not the investor, so that portion of the risk premium is priced into the instrument.

So investors end up paying taxes even though they have received no cash from the investment. The coupon rate of interest is what the bond will earn in an entire year. And most bonds pay interest semiannually, that is, two times a year. Since the accrual period is typically measured in days, we need to compute the bond’s daily earnings. Accrued interest is interest that has been earned on an annuity, bond, or other investment but has not yet been paid out. Accrued interest on an annuity is tax-deferred until it is withdrawn.

Finally, the payable account is removed because cash is paid out. This payment represents the coupon payment that is part of the bond. For example, a Treasury bond with a $1,000 par value has a coupon rate of 6%, paid semi-annually. The bond matures in two years, and the market interest rate is 4%.

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. There are two typical methods to count the number of days in a coupon payment period and the days since the last coupon period.